does td ameritrade report to irs

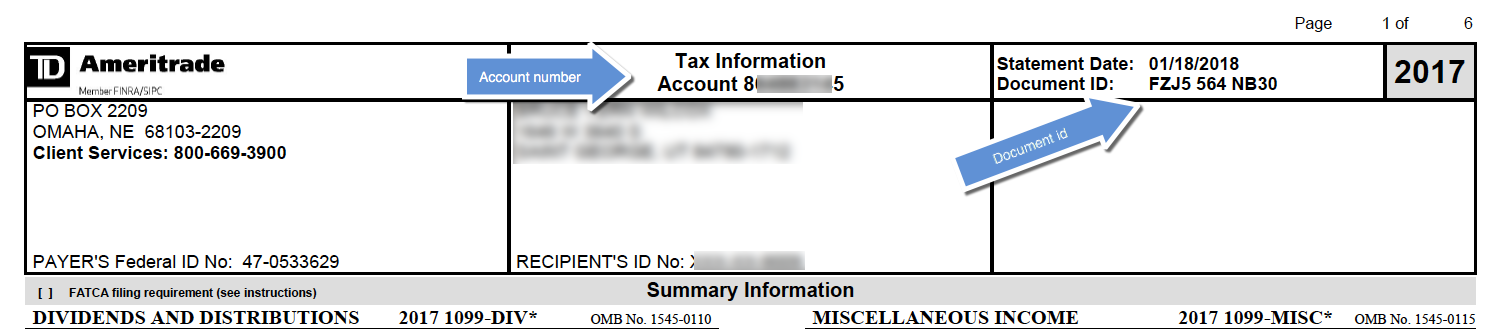

YOur CONSOlIDATED 1099 FOrM This booklet accompanies your Consolidated 1099 Form for the 2009 tax year. Download this file and submit it for processing by our program.

Logo Td Ameritrade Institutional

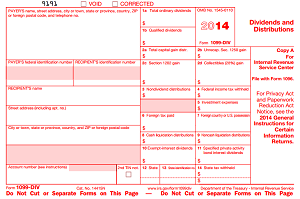

In addition to the information reported on a Consolidated Form 1099 shown at left TD Ameritrade uses the following forms.

. From there you will be able to view and. Box 2e and Box 2f. However if you have other.

Mid-to-late February Mailing date for Forms 4806A and 4806B. Click on Documents at the top of the page. However TD Ameritrade does not report this income to the IRS.

They only need the information they ask for personal use as every broker does. Information in the Supplemental Information section of the. TD Ameritrade does not report this income to the IRS.

TD Ameritrade does not report this income to the IRS. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. The reason is simple.

Box 2e - Section 897 ordinary dividends. The IRS has updated the 2021 Form 1099-DIV to include two new boxes. What other forms does TD Ameritrade use to report to the IRS.

To do this follow these steps. Do I need to report anything on my tax return if I havent withdrawn any funds from the account. I recently opened an account with TD Ameritrade.

Open an Account Now. TD AMERITRADE does not report this income to the IRS. Ad No Hidden Fees or Minimum Trade Requirements.

TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. 3 Supplemental Summary Page A snapshot of the additional information that TD. No TD Ameritrade does not sell your personal information to anyone.

Options trading was added to the requirement on January 1 2013. Ad No Hidden Fees or Minimum Trade Requirements. Then click on Tax Documents from the drop-down menu.

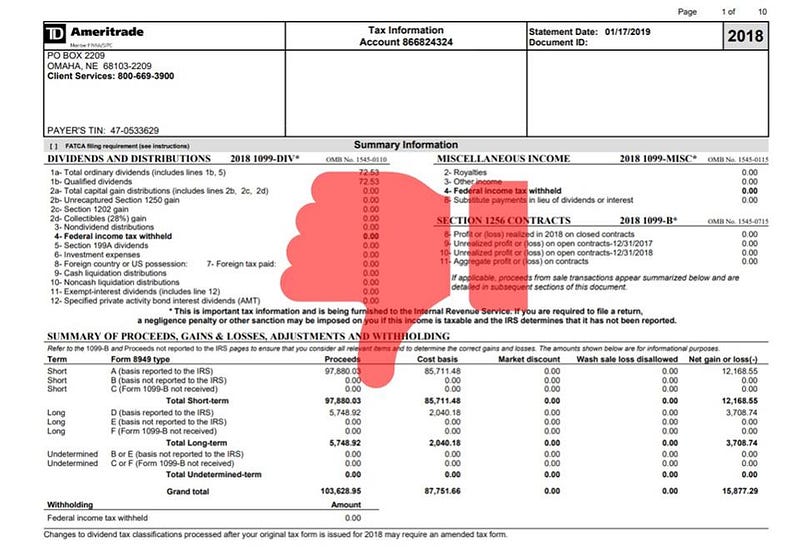

TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. But they do report the basis and sale price.

You may receive your form earlier. Your Consolidated Form 1099 does list income less than 10. Open an Account Now.

Shows the portion of the amount in. I believe they report columns 1a through 1f on forms 8949 the gain or loss is. TD AMERITRADE uses the following forms to report income and securities transactions to the IRS.

We expect 1099s to be available online by February 17 2022 by the IRS deadline. They dont report the gain or loss to the IRS. The IRS began requiring brokers to keep track of cost basis for security trades beginning in 2011 with equity trades.

You must enter the gain or.

Td Ameritrade Ofx Import Instructions

How To Read Your Brokerage 1099 Tax Form Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Get Real Time Tax Document Alerts Ticker Tape

Documents To File Your Taxes If You Have An Ira Roth Ira Or Sep By Marc Anselme Anselme Capital Blog Medium

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Td Ameritrade Says I Made 196k In 3 Months R Tax

Tax Forms Every Investor Should Know About Novel Investor

Td Ameritrade Says I Made 196k In 3 Months R Tax

What Are Qualified Dividends And Ordinary Dividends Ticker Tape